Popular donations

Our experts welcome most vehicles, trucks, vans, fleet motor vehicles, trailers, boats, motorcycles, and Mobile homes, contingent on approval. We have representatives waiting to resolve any kind of query you should have which includes: "what you can possibly donate?" and even "what shape of cars and trucks are really allowed?" Feel free to call us toll free at: (888) 228-1050

What legal documents are documentation is required?

In most instances In many cases we will have to have the title to the motor vehicle, but each state has its own guidelines. Even in the case that you don't hold title paperwork, get in touch with us anyway; other arrangements can possibly be worked out in most instances in many cases. You may connect with us by calling us toll free at: (888) 228-1050

We value your cars and truck donation, and our experts really want to help make that within reach for you. If you have other questions, you are able to check out our auto donation FAQ. Our reps are waiting on the phone, set to help you figure out any forms you have to have to donate your car or truck.

Will I have the opportunity to pick up a tax write-off?

Without a doubt, motor vehicles donated to registered non-profit organizations are definitely tax deductible. Since we are a 501( c)( 3) not for profit organization, your motor vehicle donation to Driving Successful Lives is entirely tax deductible. When we receive your vehicles donation, we will certainly mail you a receipt that lists your tax deduction amount.

In general, if the auto you give fetches less than $five hundres dollars, you can claim the fair market value of your automobile up to $500. If your donated car or truck sells for more than $500, you are going to have the opportunity to declare the true amount for which your auto sold. Learn more about how the IRS allows you to claim a tax deduction for your car donation on our IRS Tax Information page.

Your car donation to an IRS authorized 501( c)( 3) charity is still tax deductible and is going to fall under either of these particular sections:

1. With regard to automobiles marketed for under $five hundred, you are able to claim the legitimate price as much as $500.00 without having any supplementary documentation. The initial tax receipt will be here transmitted when auto has been proven picked up.

2. Supposing that the total income from the sale of your donated auto extend past $500.00, your reduction will certainly be capped to the confirmed final sale rate. You will also be asked by the donee organization to provide your Social Security for the purposes of completing its IRS Form 1098-C click here form.

We will definitely provide you with a letter setting forth the final sales price of your auto in a matter of thirty days of its sale.

Will you provide absolutely free pick-up?

Absolutely, we will grab the auto starting or otherwise free of charge, from a locale that is suitable for you. When you submit our web based donation form we will phone you the very same or succeeding check here business day in order to plan for your car or truck pick-up. If you make your vehicle donation by simply phoning us at: PHONE. We are going to plan for your pick-up at that point.

Exactly who benefits?

Our cars and truck donation solution enhance regional charities that aid children and families looking for food & shelter. Your automobile donation helps make dreams become a reality in a number of means-- including xmas presents.

We will also dispense finances to establishments that help Veterans.

Your vehicles click here donation benefits get more info disabled US veterans by raising dough to produce backing for different programs to serve to help support their needs.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Tiffany Trump Then & Now!

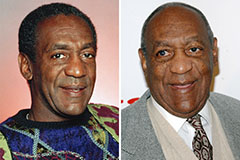

Tiffany Trump Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!